If you can’t pay your loans off each month, it’s likely not going to be approved by a lender and will end up costing you more in interest.ĥ.

21 DAY CREDIT SWEEP FULL

Only apply for credit if you have the money available to pay off the debt in full at the end of each month. This will give you regular updates on how your score is changing and help you stay aware of any potential problems that may arise in the future.Ĥ. Keep up with your credit monitoring service subscription if you have one. This will lower your overall borrowing costs and make it easier for the lender to approve a loan based on your current credit score.ģ. This will help your lenders trust that you’ll be able to pay them back in full.Ģ. Make sure all of your current bills are paid on time. Here are some tips for preparing for a credit sweep:ġ. Before you get a credit sweep, it’s important to understand the process and what to expect. How can you prepare for a credit sweep?Ĭredit sweeps are a common way for lenders to evaluate your creditworthiness. By doing a credit sweep at the right time, you can avoid potential financial problems down the road. A credit sweep will help identify any delinquent accounts and can provide you with insights into your overall creditworthiness. The best time to conduct a credit sweep is when you have identified accounts that may need attention. When is the best time to perform a credit sweep? In addition, it helps improve a person’s credit score if they have had problems in the past paying back debts. Moreover, identity theft victims can be benefited from a credit sweep. There are a few types of people who may be able to benefit from a credit sweep: people who are struggling to keep up with their payments, young adults without a credit history, and those who have recently experienced financial difficulty. A credit sweep can help improve a person’s score and may lead to better borrowing terms. Who can benefit from a credit sweep?Ĭredit scores can affect people’s access to credit, their interest rates, and their borrowing limits. However, credit bureaus and the federal trade commissions of many states have legalized credit services. In some cases, it may be considered a criminal offense while in others, it may only be considered a civil violation. The legality of a credit sweep depends on the state in which it occurs. Some of these activities may include identity theft, credit card fraud, and loan fraud. Is credit sweep illegal?Ĭredit sweep has been used in the banking and financial industry to describe numerous illegal activities.

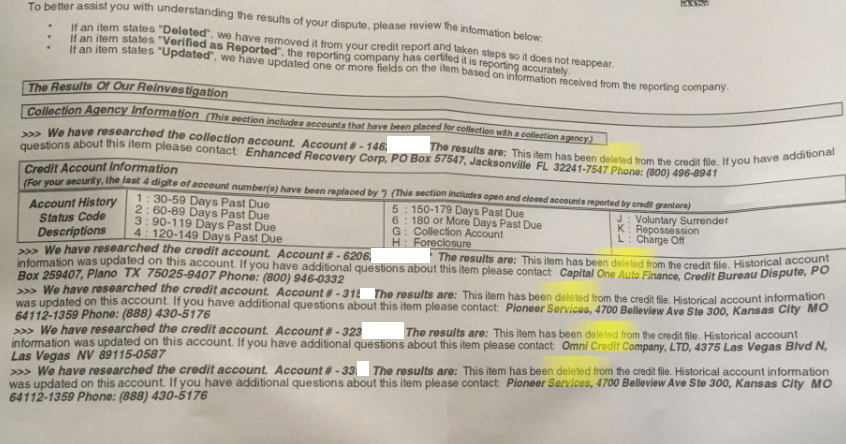

You can contact the lender and request that they remove the negative information from your report. If you get a negative credit sweep, it is possible that the lender will be unable to make an approval decision because of the information in your credit report. What happens if I get a negative credit sweep? This helps lenders get a better idea about your overall financial situation and whether you may be able to afford an upcoming loan. This way, you can keep your credit score high and improve your chances of getting a good loan or buying a house.Ī credit sweep usually includes three or four different types of checks, including a personal finance check, a current account check, and a car loan check. If there are, the company will help you fix the problem. How does a credit sweep work?Ĭredit sweeps work by monitoring your credit report to see if there are any problems. The purpose of a credit sweep is to identify and correct any inaccuracies in your reports, which may impact your ability to obtain credit. Credit sweeps can be conducted manually or electronically. In short, this is a process used by credit bureaus to verify the accuracy of your credit reports. Generally, a credit sweep involves contacting all the creditors who have loaned money to the consumer and offering to forgive their debts in exchange for monthly payments. What is a credit sweep?Ĭredit sweeps are a type of debt settlement in which a creditor agrees to forgive all or part of a consumer’s outstanding debt, provided the debtor pays off any new debts within a set period of time. Want to learn more about credit sweep? Read through our article. This can help you fix any errors on your report and improve your credit score.

When you have a credit sweep, all of your open and recent credit accounts are analyzed by a credit bureau. This process can include activities like running your accounts through a debt collector or taking legal action against you. Credit agencies use these types of evaluations to make changes to your credit report. Credit sweeps are a recent development in the credit industry, and they can have a big impact on your credit score.

0 kommentar(er)

0 kommentar(er)